The collapse of FTX has sent shockwaves through the crypto industry, putting assets under its custody at risk and unlikely to be recoverable. This has shattered trust and confidence in centralized custody platforms like exchanges, leading investors to move their assets to non-custodial (self-custody) wallets for added security.

The domino effect has also been seen, with at least 16 crypto firms halting withdrawals in the two weeks following FTX's downfall. This highlights the risks of relying on centralized entities to protect your crypto assets, or more precisely, allowing someone else to hold private keys that have access to your crypto assets on your behalf.

Not Your Key, Not Your Crypto

A popular expression in crypto world

Fully relying on a centralized entity such as a crypto exchange to hold your crypto is risky. Regardless of how much you trust the exchange, you can’t fully ensure that all funds are fully redeemable at any point in time, given that FTX’s billions of dollars are just gone in a matter of days.

In this article, we will give you a brief overview of the concept of a private key in crypto, what makes you the real owner of your crypto, different types of wallets, the difference between Custody and Self-Custody (Non-Custodial), and some recommendations for keeping your crypto 100% safe at all times.

On a side note, the information below applies to individuals and all crypto firms and institutions.

What is a Private Key?

A private key is a secure code that allows the key holder to make crypto transactions from a specific wallet. Crypto assets are never sitting inside a wallet, but rather a public ledger, which is distributed across nodes and lined up into what is known as the blockchain. To prove your ownership of holdings in a wallet, the only way is to be able to transfer the asset to another address, for which you need the private key of the wallet in which the assets are 'stored'.

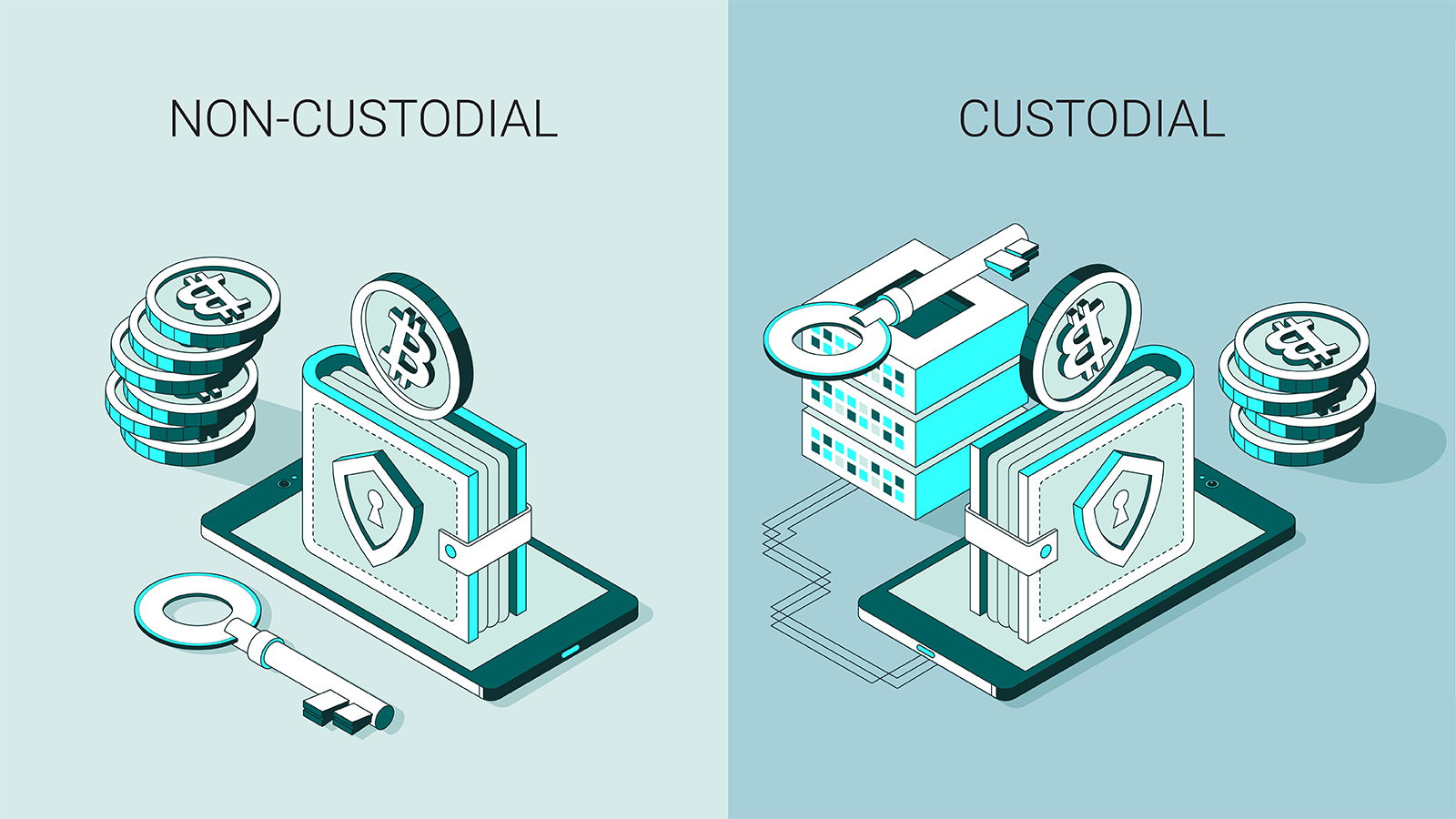

Custodial vs. Non-Custodial (Self-Custody) Wallet

As the name suggests, Custodial means your assets are under someone else's wallet, which they can move your assets around using their private key. On the other hand, Non-Custodial means you have complete control of your own assets. Let's dive deeper into their differences and also list out a few wallet examples.

Custody Wallet

There are way more custody wallets than self-custody wallets in the market, and they appear in many different ways. It can be a mobile app wallet that requires you to sign up or an exchange. Whenever you sign up for an account in a centralized crypto exchange (CEX), you will be given an address at which you can deposit assets into it. Assets are stored in a communal wallet, and what you are left with the asset custodian is an I Owe You (IOU).

To withdraw your assets, you have to make a request with your asset custodian, and they will first go through a verification process only then transfer your assets to your designated address using their private key.

It is not wrong to do so. In fact, most crypto investors are keeping their crypto assets in custody wallets. This is mainly because they buy crypto directly from the exchange, and the crypto will go straight into their custody wallet provided by the exchange. Aside from this, it is more convenient if you use crypto only for trading on a centralized exchange, compared to a self-custody wallet.

Keeping your assets in a custody wallet sounds like saving your fiat currency assets in a bank account, except that a custody wallet is not as regulated as a traditional bank. This means that the asset custodian is free to flex their pool of assets to do other investments, or worse, embezzle them.

What makes things worse here is that there is no transparency or guarantee as to who has access to the wallet's private key. Assets are usually distributed across a few wallets (cold, warm, and hot wallets) and private keys are given to a few trusted employees to run daily operations, such as payouts and so on. Private keys given could be stored in a mobile phone or laptop, it can be a dedicated device for approving transactions, or it could be a daily use device that is vulnerable to malware and accessible by technical staff inside the company.

Here is a list of benefits and drawbacks.

Benefits

Convenient to trade in CEX

You can trade instantly on a centralized exchange using the custody wallet you are currently using.

Save gas fee

Because tokens and coins are simply figures in your asset custodian database, no actual transactions are made on the blockchain, and therefore, no gas fees are incurred.

No need to remember a seed phrase

A custodial wallet is password-protected and can be recovered using email or other methods, so there is no need to remember a seed phrase.

Easy access

A custodial wallet is centralized, device-agnostic, and usually web-based, making it accessible from anywhere in the world.

Drawbacks

Less secure

You have no control over who has access to the private key holding your assets.

Provider reliant

If the company providing the custodial wallet goes out of business, you may lose access to your assets.

Lack of control

You have no control over how your assets are used or stored, as you do not hold the private key.

Subject to charges

Some custodial wallets may require a recurring fee for their services.

Example Custodial Wallet for Individuals

Example Custodial Wallet for Institutions

Non-Custodial (Self-Custody) Wallet

As the quote says 'Not Your Key, Not Your Crypto', whoever holds the private key associated with your assets has true ownership. A non-custodial wallet gives you complete control over the private key. Although it tends to be more complex, technically, it gives you the freedom to move assets around. This is the type of wallet favored by experienced crypto investors in general.

Non-custodial wallet gives you freedom, with more freedom means more responsibility. There is no such thing as 'Reset password' in the non-custodial wallet, the seed phrase is the only way to recover your asset in wallet if your wallet device is lost. Seed phrase is the derivation of your private key, a phrase that consists of 12-24 random words. Layman, seed phrase is an easier-to-remember backup password to restore your private key. If the seed phrase is lost, it generally means all assets associated with the seed phrase are gone as well.

There are 2 types of non-custodial wallet, which is Software and Hardware wallets. Software wallets can be a desktop or mobile app, they stores and encrypts private keys in the device's storage. It is also widely used to connect to Web3 applications through connectors like Wallet Connect or Web3-friendly wallets like Metamask and Phantom.

On the other hand, Hardware wallets are a more secure type of non-custodial wallet. It resembles a USB thumb drive and it only goes online if it is connected to a computer or mobile device. The signing of transactions using a private key happens inside the device itself and it will only broadcast to the blockchain when it is online. This makes hardware wallets impervious to hackers.

Again, here are the summarized benefits and drawbacks of non-custodial wallets.

Benefits

Full control of your assets

You are the only person holding your private key

Easy to create

Does not need email to register, and no KYC process.

Advanced Functions

Non-custodial wallets support Web3 DApp, NFT, testnet, other than making transactions.

Support More Coins and Tokens

You can have more token choices in your wallet by adding them using a contract address.

Drawbacks

Difficult to use

Slightly more difficult to use compared to a custodial wallet, It requires some technical knowledge to use.

No way to recover assets

The seed phrase is the only way to recover your assets, seed phrase lost = assets gone.

Accountability

Full control is a double-edged sword, full control of assets also means you take full responsibility for all the losses if the private key is stolen.

Less Accessible

You can't 'login' to your wallet anywhere, although you can use the seed phrase to recover assets in several wallets, but such practice is super risky and is a downright no-no.

Non-Custodial Wallet for Individual Investors and Tech Professionals

- Metamask (Most widely used Web3 wallet)

- Exodus

- Trust Wallet

- imToken

- Coinomi

Non-Custodial Wallet for Firms and Institutions

Summary

The collapse of FTX pushed crypto investors to move towards non-custodial wallets. Even before that, the Celsius and Three Arrow Capital incidents had already sent a red flag to crypto investors. You may describe using a custodial wallet as leaving your piggy bank to others, and you have no idea of where they keep it, it could be in a safe or could be in their bedroom.

CoinsDo, as an asset custody solution provider, specializes in providing non-custodial wallet technology. We highly recommend not letting your digital assets sit in a custodial wallet, not only for individual investors but also for institutions or business owners.

Here are some final advice and recommended wallets

Dos and Don’ts of Using Self-Custody or Non-Custodial Wallet

- Keep all your less active assets in a cold wallet, and use only a hot wallet for transactions and Web3 applications.

- Use hardware wallet as cold wallet, otherwise, factory reset an old/unused phone and use as cold wallet.

- Mitigate hot wallet's asset risks by using a few wallets, especially for firms.

- Avoid using a PC software wallet and try using it on a mobile phone, there are cases of wallet hacks by remotely controlling the PC or using malware.

- Do your research and ensure it is safe before connecting to a new DApp.

- Do not store your seed phrase online, write it on paper or use metal plates.